After ordering a bitcoin reserve, the president ushered crypto CEOs into the White House today to tell them their era of U.S. government resistance to crypto is over.

Updated Mar 7, 2025, 9:51 p.m. UTCPublished Mar 7, 2025, 9:19 p.m. UTC

WASHINGTON, D.C. — President Donald Trump assured the crypto sector that it's on new ground in a first-ever summit at the White House on Friday, illustrating what the industry suspected: It's got friends at every level in Washington.

"I know that many of you have been fighting for years for this, and it's an honor to be with you at the White House," Trump said as the White House meeting got underway.

In his brief statement, Trump said he would end his predecessor's “war on crypto,” praised lawmakers' legislative efforts and discussed his new Bitcoin reserve.

“Regulators strong armed banks. I mean, they really did – They strong armed banks into closing the accounts of crypto businesses and entrepreneurs, effectively blocking some money transfers to and from exchanges, and they weaponized government against the entire industry,” Trump said. "But I know that feeling also maybe better than you do. All of that will soon be over and we are ending Operation Chokepoint 2.0."

Trump said he wanted to sign stablecoin legislation before Congress breaks for the August recess.

"I also want to express my strong support for the efforts of lawmakers in Congress as they work on bills to provide regulatory certainty for dollar-backed stablecoins and the digital assets market," he said. "They're working very hard on that. This is a tremendous opportunity for economic growth and innovation in our financial sector, and will really go a long way."

Referring to his Thursday executive order creating a Bitcoin reserve, Trump said it was "foolish" that the federal government had already sold so much of its seized Bitcoin

"The federal government is already among the largest holders of Bitcoin, as you know, really one of the largest holders in the world, with as many as 200,000 Bitcoin obtained via civil law and various other forms of law, including enforcement actions," he said. "These existing holdings will form the foundation of the new reserve."

"From this day on, America will follow the rule that every Bitcoiner knows very well, never sell your Bitcoin," he said.

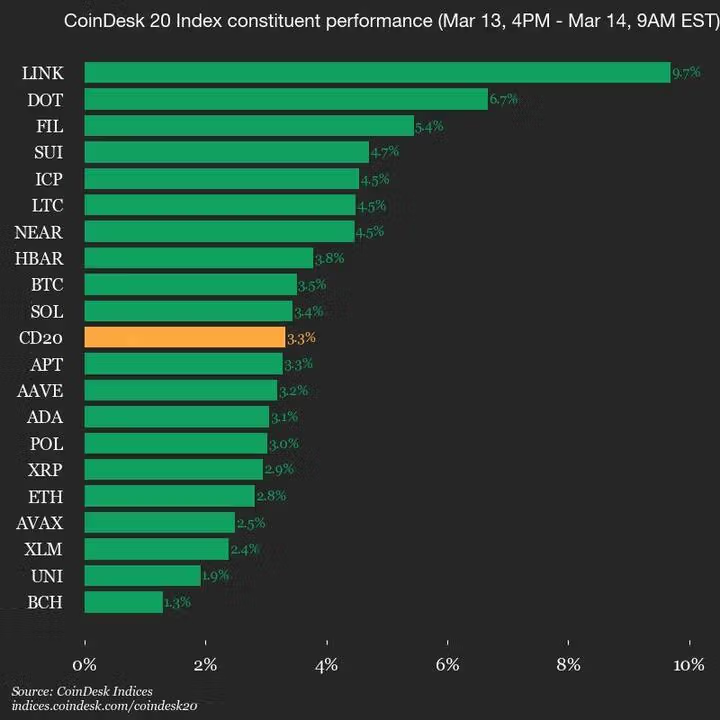

Wide swaths of the industry were represented by the guest list, which included top executives of Coinbase, Ripple, Kraken, Gemini, Chainlink, Robinhood and many others, representing the most formal-looking crypto group since the black-tie ball celebrating Trump's election victory. Tyler and Cameron Winkelvoss of

Gemini, and Sergey Nazarov of Chainlink were among those who spoke during the live-streamed portion of the summit.

Earlier on Friday, a senior White House official further clarified the administration's position on its bitcoin reserve and the secondary crypto stockpile that Trump's order is meant to establish. The official said that the U.S. government has an estimated 200,000 bitcoin to start the reserve and will be conducting an audit to figure out the specific holdings, and any non-bitcoin seizures will be maintained in the other stockpile. No new money will be put into non-bitcoin assets, and any active future investments in bitcoin will have to be worked out in a way that doesn't use tax dollars, the official said.

The afternoon summit was largely meant to set a tone from the administration, which has sought to quickly put digital assets on friendlier footing than the industry experienced during the administration of former President Joe Biden.

Jesse Hamilton

Jesse Hamilton is CoinDesk's deputy managing editor on the Global Policy and Regulation team, based in Washington, D.C. Before joining CoinDesk in 2022, he worked for more than a decade covering Wall Street regulation at Bloomberg News and Businessweek, writing about the early whisperings among federal agencies trying to decide what to do about crypto. He’s won several national honors in his reporting career, including from his time as a war correspondent in Iraq and as a police reporter for newspapers. Jesse is a graduate of Western Washington University, where he studied journalism and history. He has no crypto holdings.

Cheyenne Ligon

On the news team at CoinDesk, Cheyenne focuses on crypto regulation and crime. Cheyenne is originally from Houston, Texas. She studied political science at Tulane University in Louisiana. In December 2021, she graduated from CUNY's Craig Newmark Graduate School of Journalism, where she focused on business and economics reporting. She has no significant crypto holdings.

Nikhilesh De

Nikhilesh De is CoinDesk's managing editor for global policy and regulation, covering regulators, lawmakers and institutions. When he's not reporting on digital assets and policy, he can be found admiring Amtrak or building LEGO trains. He owns < $50 in BTC and < $20 in ETH. He was named the Association of Cryptocurrency Journalists and Researchers' Journalist of the Year in 2020.

(1).png)

6 days ago

2

6 days ago

2

English (US) ·

English (US) ·